Netflix vs Disney+ Subscribers & Trends Around The World

Both streaming services achieve high visibility but for different reasons.

Netflix is reported to have 301.6 million subscribers worldwide; 173.6 million more than the reported figure for Disney+, who has 128 million subscribers around the globe.

Netflix vs Disney+ in the USA

Our research shows that while Netflix is more popular generally, there are different reasons for the usage of the services.

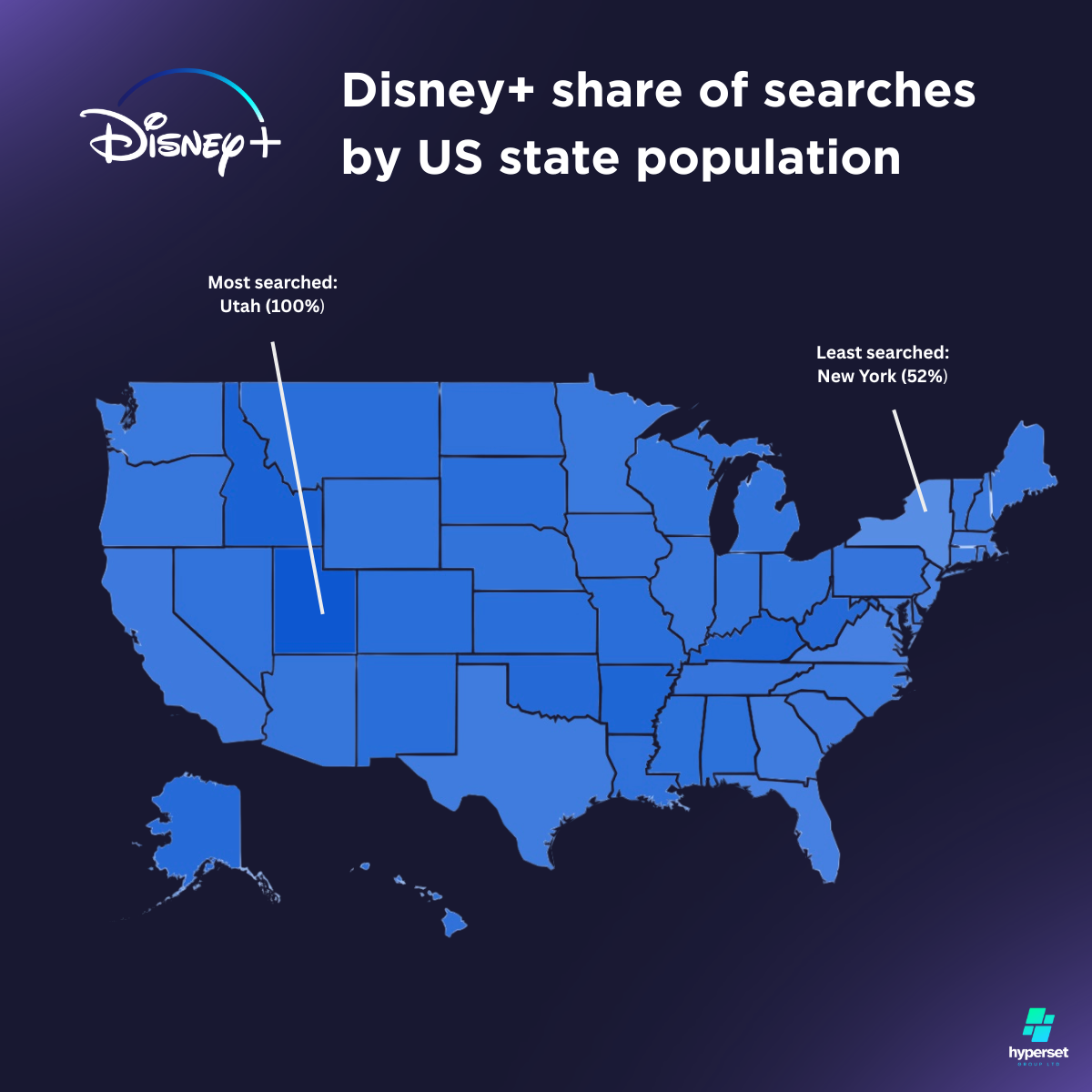

For example, the state of New York searches for Disney+ the least based on online searches per state population. The state that searches for it the most is Utah.

This LinkedIn post describes the Disney+ search traffic across the USA in more detail:

When we compare this to the results for Netflix, we see some key differences.

Vermont is the state that searches for Netflix the most based on population size; Nebraska shows the least interest in terms of searching the brand online. However, New York shows a strong result – in stark contrast to Disney+.

This may confirm that Disney+ is central for households with children – something not neccessarily associated with NYC.

We can also see Netflix achieves better visibiltiy than Disney+ across America as a whole. The difference between the states that show the highest and lowest search interest in Netflix is lower (26% difference) than it is for Disney+(48%).

Netflix vs Disney+ in search traffic around the world

Netflix is generally recieves more non-branded traffic around the world than Disney+ does. This means in short, more people find the service by searching for a show title rather than the brand itself. This is true in countries such as Mexico, Australia, UK, USA, Canada, Brazil and Germany. However, the opposite is true in India and France – this may well represent areas where the Disney+ brand is not as strong.

This is described in the LinkedIn post below.

Netflix & Disney+ vs other streaming services in the UK – and what this means…

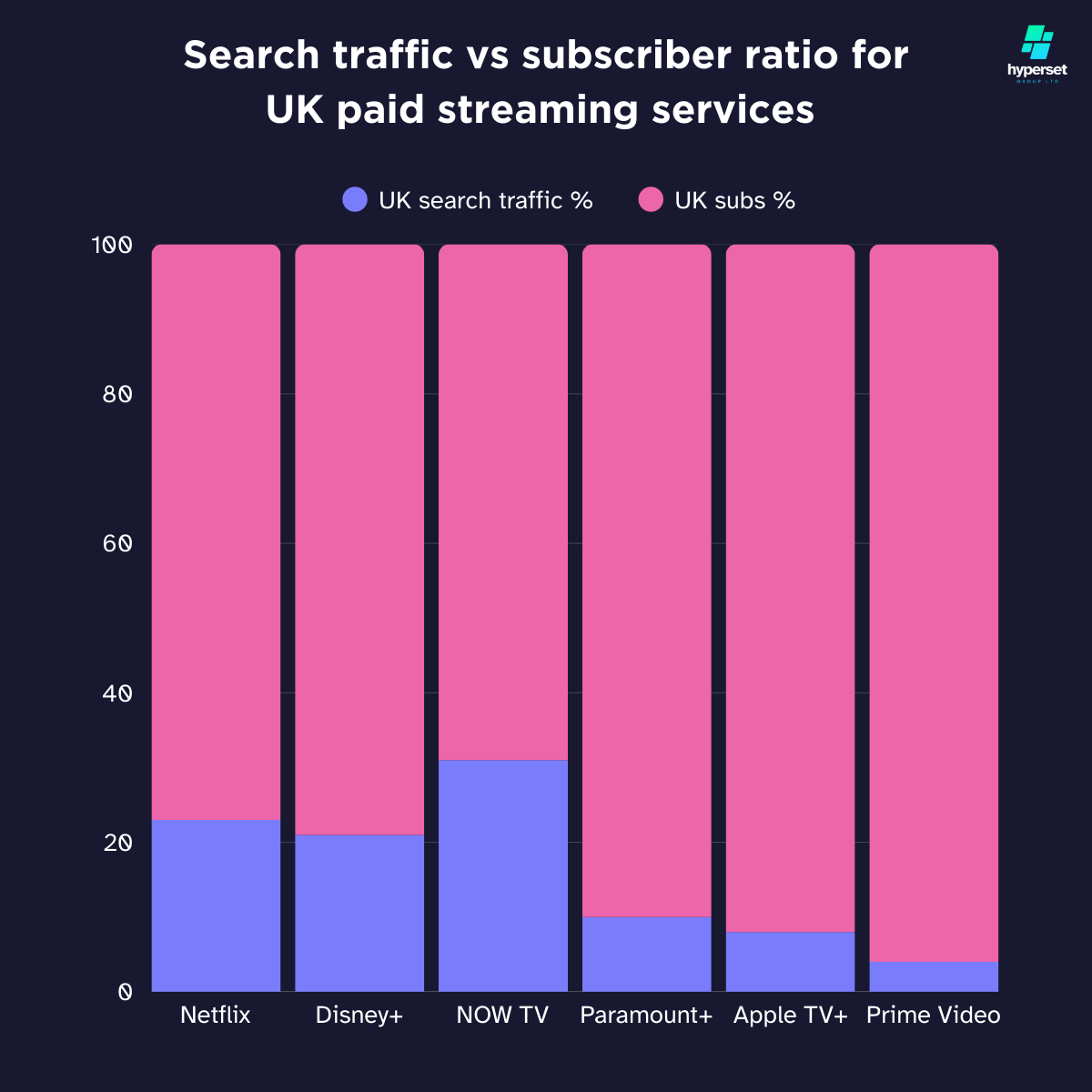

When assessing search traffic as a % of subscriber ratio in the UK, we can see Netflix and Disney+ hold the middle ground compared to other OTT services in the region. This is also typical around much of the world.

Standalone servises such as NOW TV have a search to subscriber ratio of 31% – this is good beacuse people are knowingly paying for a valuable service. This is also bad, because people are continuously weighing up it’s value and as a result are more likely to become a churn risk.

On the other end of the scale, OTT services like Prime Video are deeply embedded in to larger eco-systems and are not searched for outside of the using of the service itself. This means churn is likely to be low, however, many users are indifferent to the service itself.

By holding the middle ground on this scale, both Netflix and Disney+ are in strong positions in terms of brand and service quality.

Where do people search for Netflix around the world?

16% of global searches for Netflix come from the USA. Brazil is second with a 9% share and India third with 7.2%. The full list is detailed on the map below.

If you would like a 15 minute call about TV audience analytics, please send an email to stefan@hypersetgroup.com and we’d be glad to see how we can help.

Leave a Reply